Christopher Frye, market research consultant and Kolabtree freelancer, shares his expert advice on how to conduct market research for a new product.

Many entrepreneurs and owners of small businesses contend with a frequent problem: I have a product idea but I have no idea who might use it, why they would use it, how much they would pay, or how many potential customers there are. This is where conducting proper market research can be the difference between a failed launch and a successful product over the long term.

This blog post seeks to provide some basic information on the different types of market research that can be used to inform product strategies, as well as a sampling of publicly-available data and tools for conducting market research.

Types of Market Research

Conducting market research to assist in product development efforts is a critical step. The two primary outputs of market research (among many others) is a better understanding of your product’s potential customers and market, and how you might differentiate your product to compete more effectively.

Entrepreneur provides a useful summary definition of market research:

The process of gathering, analyzing and interpreting information about a market, about a product or service to be offered for sale in that market, and about the past, present and potential customers for the product or service; research into the characteristics, spending habits, location and needs of your business’s target market, the industry as a whole, and the particular competitors you face.

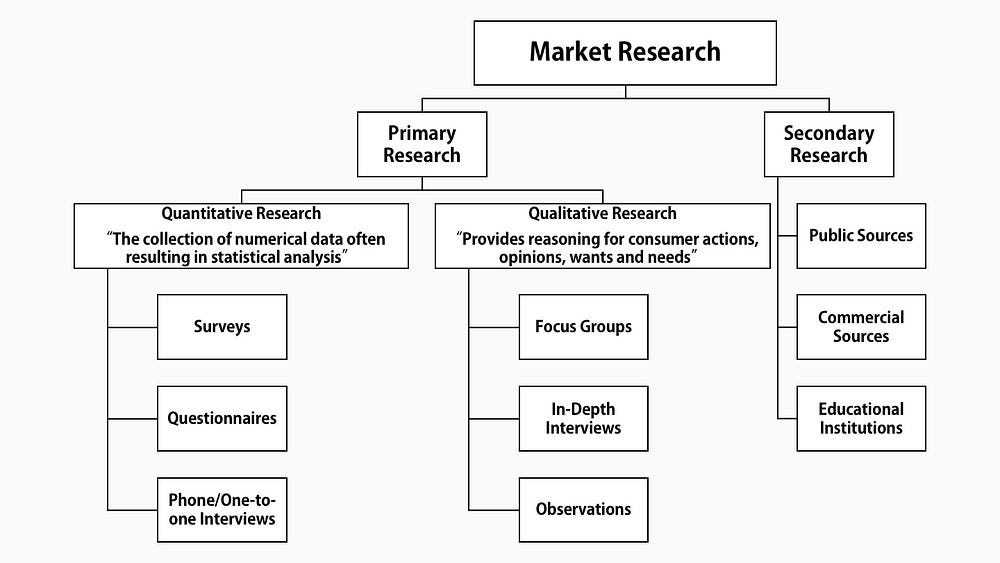

Primary Market Research

Primary market research is the most traditional type of market research and is most closely associated with customer surveys, in-depth interviews, or any activity that involves gathering feedback from customers or potential customers. It can be further segmented into quantitative, which provides for enumerating a specific market, and qualitative, which can probe for the drivers influencing product purchase. For the purposes of this post, product and service are being used interchangeably.

For those looking to introduce a product to market, primary market research should strive to answer three core questions:

- who is in my target market,

- is there appeal among my target market for my product, and

- what would my target market be willing to pay for my product.

Defining a Target Market

Regardless of whether you use a survey or focus group to collect information on your target market, you need to be able to define those who would most likely be interested in your product to ensure you are collecting information from the appropriate individuals. While one may hope their target market is everyone, this is generally not the case, and the more specific you can be in defining your particular niche or market segment, the better your marketing efforts will be in capturing them.

Definitions of your target market should focus primarily on the demographic characteristics that describe them, for instance, age; gender; race/ethnicity; income; geographic location; lifestage; household composition; in addition to virtually any characteristic that defines an individual. In addition to demographic characteristics, another important area of focus are characteristics that are related to behavior, attitudes, values, motivators, and other psychographic characteristics. Demographic characteristics allow for specific targeting, while psychographic characteristics provide insights about the thought processes that underlie a purchase decision.

A primer on the exact process regarding how you should define your target market is beyond the scope of this post, but answering these three questions will provide a decent basis for arriving at a target market:

- What need or pain point is currently being experienced that your product addresses? Aligning product features with customer needs allows you to envision who might fit best with your product.

- What are the combinations of demographic or psychographic features that would reveal the optimal intersection and ideal customer segment? Again, that align specifically with your product.

- What is the most articulate unique selling proposition my product espouses? To some extent, this is related to the first, but requires additional matching between feature and segment characteristics.

Measuring Product Appeal

Once you have arrived at a proper target market definition, the other two pieces of information required include whether or not your product (in its current form) will appeal to your target market, and how much are they willing to pay. Product appeal can be measured in simple ways (i.e. “Thinking about this product concept, how likely would you be to purchase?”) to more complex ways such as conjoint analysis. Conjoint analysis measures appeal by presenting product scenarios (varying attributes) to respondents and having them choose one over another (or choose neither). For much more detail on concept testing, see this comprehensive guide from SurveyMonkey.

Measuring Willingness to Pay

Willingness to Pay for a product can also be conducted in a variety of ways, including from actual market data (what price are customers currently paying for similar products), experiments, indirectly (through methods such as conjoint analysis where price is included in the mix of product attributes), or directly. Direct methods include what is known as the Van Westendorp approach, which asks a series of questions to identify the range between expensive and inexpensive, and the optimal price point. Another method is what is called the Gabor-Granger method, where respondents are randomly assigned to a price point, with subsequent questions either increasing (if they are willing to pay the initial price) or decreasing (if they are not willing to pay the initial price). The algorithm is repeated until the highest price respondents are willing to pay is found.

Developing key information addressing these three core areas (defining a target market, measuring appeal, and measuring willingness to pay) can form the basis of a go-to market strategy.

Secondary Market Research

Secondary market research involves assessing market research that has already been conducted or primary documents that can be used in gaining a better understanding of your market. These could include publicly-available reports or presentations from large market research consultancies, trade associations, government agencies, or peer-reviewed journal articles.

While secondary market research is generally perceived to be secondary to primary market research, any product or business strategy should be informed by secondary research first. Conducting a proper assessment of secondary research that is available allows one to identify those research objectives not answered by secondary research and where primary research will be needed. Small businesses often do not have the resources to conduct a full-fledged and thorough secondary research – that’s where hiring a freelance researcher can help.

This resource provides a good visual for understanding the differences between these two critical types of market research and what each contains.

Publicly Available Tools & Data for Market Research

There is a wealth of information available publicly (and in many cases, for free) that can be accessed to gain a clearer picture of your specific market. This information can include the market size, how customers can be defined, and how your product competes with similar products in the market. In each of the three subject areas, we have provided a sampling of the most relevant tools & data available.

Tools for Defining Market Size

The following tools are useful in developing a market size for a specific product.

- American FactFinder: This represents the U.S. Census Bureau’s flagship resource for accessing publicly available data on US individuals, households, families, and businesses.

- Business Dynamics Statistics: This is a sub-site within the U.S. Census Bureau architecture that provides more macro level information on business dynamics (such as establishment births and deaths, number of establishments, etc.); as such it provides good market overviews.

- USA.Gov Statistics: Formerly known as Fedstats, subsequently removed in February 2018, this site is a page with links to multiple agencies providing official data sources, including Bureau of Economic Analysis, Bureau of Labor Statistics, among others.

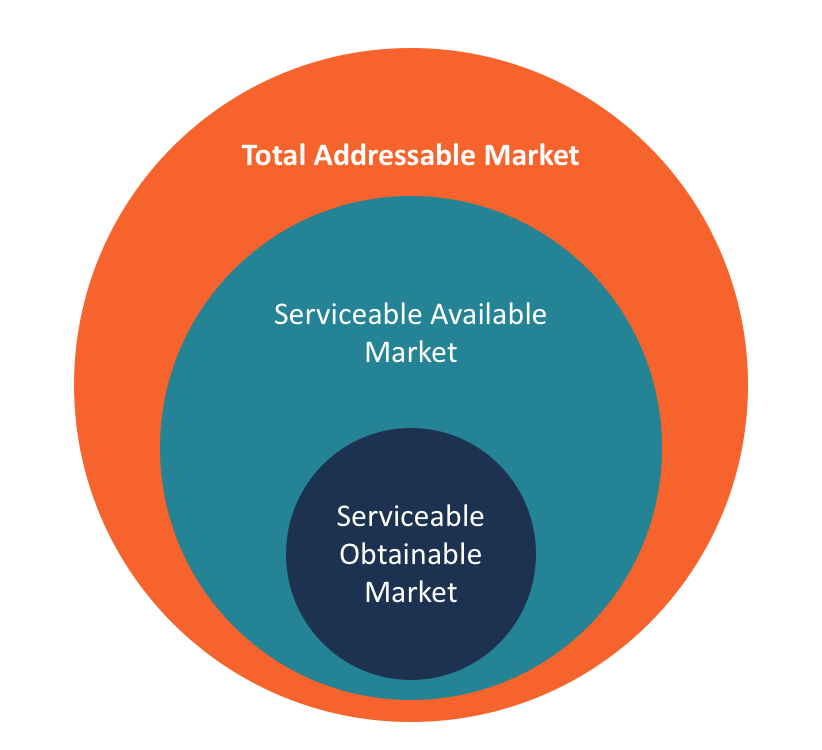

For example, a product that, based on developing use cases would likely appeal to women, aged 25-39 with incomes above $75,000 could be assessed against actual data to estimate total market size. In the construction of these estimates, common components developed include ubiquitous acronyms in this space called TAM, SAM, and SOM.

TAM = Total Addressable Market

SAM = Serviceable Available Market

SOM = Serviceable Obtainable Market

Source: Corporate Finance Institute (accessed 7/16/2019)

The total addressable market represents the largest component, as it represents the total demand for a product or service, while the serviceable available market (SAM) and the serviceable obtainable market (SOM) are subsets of this figure. SAM represents the market served by a company’s products or services and SOM represents the portion of SAM that is realistically achieved, based on market constraints. For more information, see this primer.

Tools for Customer Segmentation

Publicly-available resources that focus on customer segmentation allow entrepreneurs and business owners to gather more detailed information about potential customers in terms of their demographics, attitudes, behaviors and spending patterns. Customer segmentation techniques run from simpler approaches that may focus on combining demographics and behaviors into broad segments, or include more advanced statistical techniques.

- Claritas MyBestSegments: This site, administered by Claritas (formerly owned by Nielsen until 2016), provides information about their proprietary segmentation models, and multiple clusters, as well as a zip code lookup that provides free key demographics and segments at the zip code level.

- MakeMyPersona: Personas are increasingly used in digital marketing to provide a representation of your ideal customer, or multiple segments. MakeMyPersona is a free site that allows you to develop a persona based on answering a series of questions about your customers.

- Pew Research Center: While this may not seem at first glance to be as relevant for customer segmentation, the Pew Research Center produces a world of information on trends in the US, as well as producing reports occasionally which consist of consumer segmentation analysis.

Tools for Competitive Analysis

Successful product development requires a full understanding of where your product fits within the market, and how you can effectively position and differentiate it from other offerings. Competitive analysis provides a basis for assessing product positioning and requires research into other companies that provide similar products or services. The tools below represent a sampling of some of the resources used in this space.

- Google Trends: This resource provides a snapshot of what “the world is searching”. From a competitive analysis perspective, it can allow you to assess consumer social media and search behavior focused on your particular industry.

- SimilarWeb: This is a paid site though it does have a free tier; SimilarWeb allows you to assess your competitors in terms of both content and traffic activity, including referring sites and destination sites. For content marketing, it allows for assessing what visitors search for and other sites they visit.

- BuzzSumo: This is also a paid site, though it is considered one of the better sites for those who execute content marketing to find out what topics are popular and which sites are generating “buzz”. It provides a quick way to measure you against your competitors.

While a number of these tools are not free, some other free tools that do provide information on competitors include Owler, and Crunchbase, which both provide some level of detail (in the free version) on companies. Other honorable mentions include Alexa, SEMRush, Ahrefs, and Serpstat.

By no means, should these lists of resources be seen as exhaustive, as there are a number of additional resources (particularly with regard to online assessment of competitors) available to those wanting to leverage them in their business planning efforts. That said, developing a business plan and strategy by focusing on these critical steps should provide an adequate grounding for product offering success.

——–

Looking for help to conduct market research for your product? Post your project on Kolabtree and get quotes from freelance experts for free. You can also consult Christopher Frye directly here.